What is Real Estate Investing?

Real estate investing is a tried-and-true way to build wealth . Real estate investors acquire, hold, and flip properties to create financial stability. This guide details what it means to be a real estate investor, covering different types of real estate investments, strategies for success , what is house wholesaling and potential challenges.

Different Real Estate Investment Options

1. Investing in Residential Properties

- Single-Family Homes: Houses meant for single-family occupancy. These are common among novice investors due to their manageable investment size and straightforward maintenance.

- Multi-Family Properties: Properties that house multiple families, including duplexes and apartments. They provide more rental revenue but need increased oversight .

- Vacation Rentals: Homes leased for short stays, typically via sites like Airbnb. These can yield more profit but may have more frequent vacancies and need more oversight.

2. Commercial Real Estate

- Office Buildings: Spaces leased to businesses for office use. They often have long-term leases , ensuring stable cash flow.

- Retail Properties: Buildings leased to retail businesses, such as shopping centers, malls, and storefronts. Success is dependent on tenant profitability.

- Industrial Properties: Industrial buildings such as factories and storage units. These have protracted agreements and require little oversight.

3. Investing in Industrial Properties

- Warehouses: Buildings for storing products and supplies. Demand is fueled by online shopping expansion .

- Manufacturing Facilities: Buildings used for production and assembly of goods. These need expert understanding to invest .

- Distribution Centers: Central points for shipping and logistics. Crucial for efficient supply chains .

4. Investing in Land

- Undeveloped Land: Land that has not been improved or built upon. It offers speculative investment opportunities but can be risky .

- Developed Land: Land that has been prepared for construction, such as subdivided plots. Requires significant investment and development expertise .

- Agricultural Land: Property used for agricultural purposes. Offers consistent profitability but requires farming expertise .

Real Estate Investment Strategies

1. Long-Term Holding Strategy

- Overview: Purchase properties to rent out and hold them for the long term to benefit from rental income and property appreciation.

- Pros: Consistent rental income, tax advantages, and property value growth.

- Cons: Demands management effort, capital commitment, and market dependency.

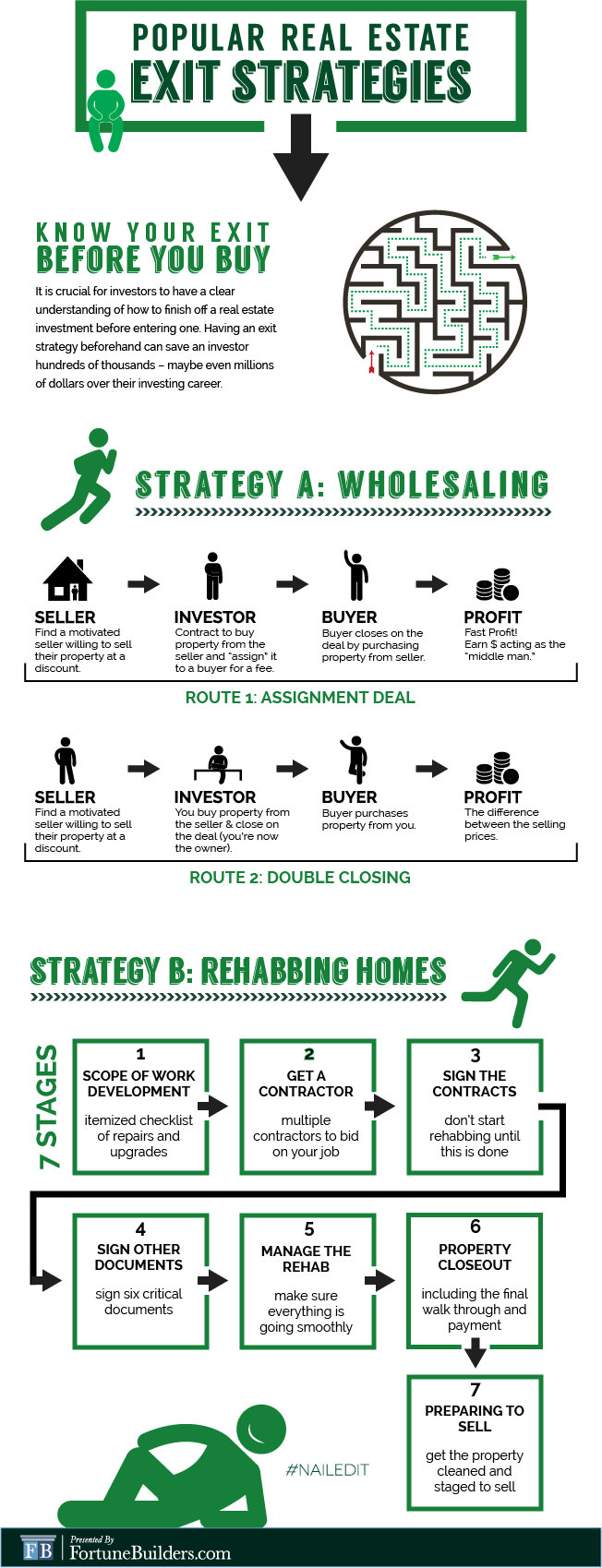

2. Property Flipping

- Overview: Buy properties at a discount, renovate them, and sell them at a higher price.

- Pros: High profit potential in a short period, property improvement.

- Cons: Risky, needs building knowledge, sensitive to market changes.

3. Property Wholesaling

- Overview: Discover discounted properties, put them under contract, and sell the contract.

- Pros: Requires little capital, fast deals, no property upkeep.

- Cons: Dependent on finding deals and buyers, smaller profits.

4. REITs (Real Estate Investment Trusts)

- Overview: Buy shares in companies that manage income-generating properties.

- Pros: Easy to sell, diversified holdings, passive returns, expert management.

- Cons: Market volatility, less control, fees and expenses.

5. Real Estate Crowdfunding

- Overview: Invest collectively in real estate projects via crowdfunding sites.

- Pros: Affordable entry, diverse investments, involvement in significant projects.

- Cons: Reduced control over investment, platform costs, potential risks.

How to Become a Real Estate Investor

Education and Research:

Learn the Basics: Gain knowledge about real estate trends, funding methods, property upkeep, and investment approaches.

Networking: Join investor groups, go to real estate seminars, and make connections with other investors.

Set Investment Goals:

Define Objectives: Determine your investment goals, such as income generation, capital appreciation, or portfolio diversification.

Set Investment Goals

- Define Objectives: Set clear goals for your investments, whether for income, appreciation, or diversification.

- Risk Tolerance: Assess your risk tolerance and choose investment strategies that align with it.

Develop a Business Plan

- Market Analysis: Study target areas, property kinds, and investment outcomes.

- Financing Strategy: Plan your financing, including mortgages, private loans, and personal savings.

Build a Team

- Key Professionals: Assemble a team with agents, lawyers, accountants, managers, and contractors.

- Networking: Keep expanding your professional network for support.

Start Small

- Initial Investment: Start with modest investments or basic projects for learning.

- Learn and Adapt: Use early investments as learning experiences and refine your strategies.

Scale Up

- Growth: Gradually increase the size and complexity of your investments as you gain experience and confidence.

- Diversification: Broaden your investment portfolio with varied properties and areas.

Challenges and Risks in Real Estate Investing | Potential Challenges and Risks

1. Market Volatility

- Economic Factors: Real estate markets can be influenced by economic changes, interest rates, and government policies.

- Mitigation: Keep up with market trends and adapt your strategies.

2. Property Management

- Tenant Issues: Managing tenant issues, vacancies, and rent collection requires effort.

- Solutions: Use a management company or improve your own management abilities.

3. Financing and Cash Flow

- Funding Challenges: Getting funding and managing cash flow can be challenging.

- Strategies: Create a robust financing strategy and keep a reserve for emergencies.

4. Legal and Regulatory Issues

- Compliance: Make sure your investments adhere to legal requirements.

- Advice: Work with legal experts to understand and follow regulations.

Final Thoughts

Real estate investing offers numerous opportunities to grow wealth and meet financial objectives. By understanding real estate wholesaling explained different types of investments , developing a strong strategy, and being prepared for challenges , you can succeed in real estate investing. Whether you are a beginner or an experienced investor , continuous learning and adaptability are key to building a profitable portfolio.